District Tax Information

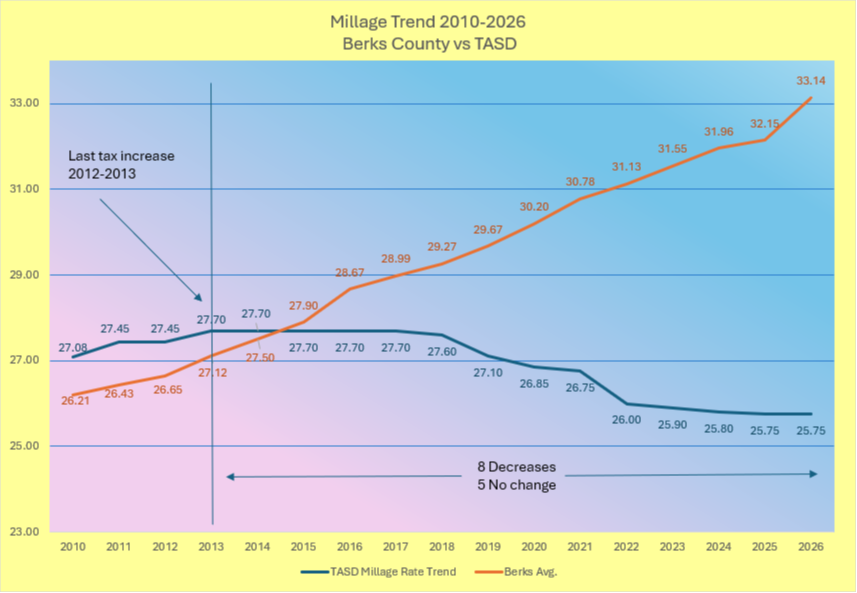

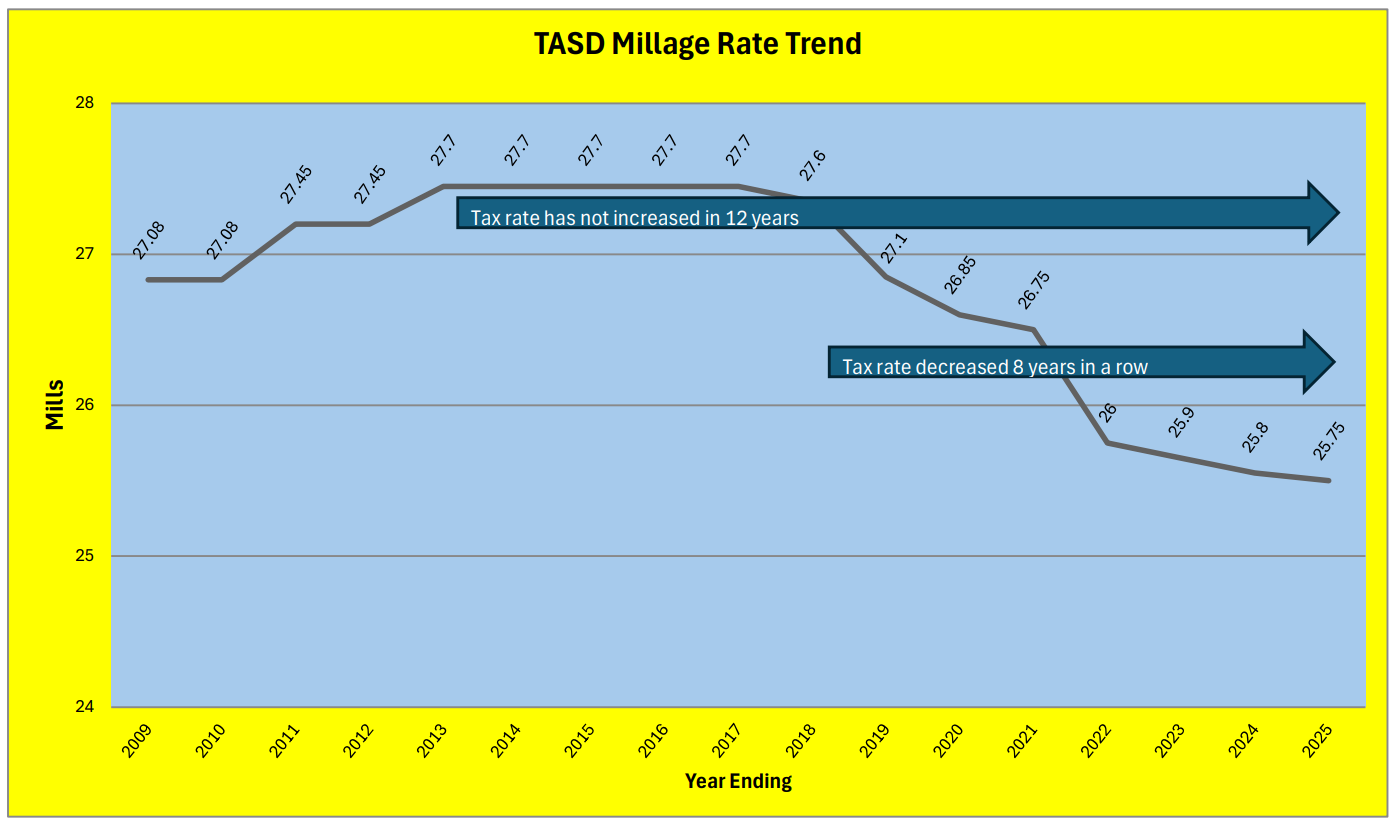

After the 8 consecutive years of real estate tax decreases, the Tulpehocken School Board made no change to the real estate tax rate for the 2025-2026 school year. The approved rate for the 2025-2026 school year remains at 25.75 mills. The graph below compares our tax rate to the Berks County school district average rate over the past 16 years. Tulpehocken’s rate is 1.3 mills (4.92%) lower than it was 16 years ago, while the average Berks County school district’s rate increased by 6.93 mills or 26.4% for the same period. The recent construction of warehouses along the I78 corridor has increased the district’s revenue substantially and the administration and school board have consistently managed expenses to provide an educational program that balances the interests of all stakeholders.

The Tulpehocken Area School District levies a series of local taxes to generate revenue for the operation of education programs. Following is a list of the local taxes and the respective rates:

Real Estate Tax - 25.75mills

Per Capita Tax - $15.00 (School portion is $10.00, Municipality/ Township is $5.00)

Earned Income Tax - 1% of wages ( School .5%, Municipality/ Township .5%)

Real Estate Transfer Tax - 1% of sale price ( School .5%, Municipality/ Township .5%)